Moore wealth management

TRUST - INTEGRITY - RESPECT

Built on honesty, integrity, and personal service, Moore Wealth Management is looking to partner with you to help you reach your financial potential. Our goal is to create a comprehensive retirement strategy that utilizes investments, insurance, risk management, tax planning, and estate planning. Whether you need a comprehensive plan to pass on your legacy to your family or just a fresh look at an old retirement plan, an exhaustive explanation of rolling over your 401(k), or a simple, no-frills rundown on how to minimize your taxes, you’ve come to the right people.

By providing undivided attention to clients throughout the planning process and beyond, Moore Wealth Management can ensure that clients receive the support and guidance they need to sustain and enjoy their retirement years. With a focus on personalized service and a comprehensive approach to retirement planning, Moore Wealth Management can help clients reach their financial potential and achieve their retirement goals.

We understand that there is no one-size-fits-all approach, which is why every client gets our undivided attention, from planning to execution to follow-up. You’ve worked hard to get yourself to retirement; it’s our job to help you sustain and enjoy it.

SHAWNA MOORE, RICP©, FSCP©, LUTCF©

FOUNDER & FINANCIAL ADVISOR

With more than 25 years of experience in the insurance and financial services industry, Shawna Moore has built her career around one simple belief: retirement planning should feel personal, supportive, and genuinely helpful. She began working in her parents’ agency while still in high school and later ran her own agency at just 23, gaining early insight into how to guide families through some of life’s most important financial decisions.

Today, Shawna focuses on helping individuals and couples who are approaching retirement and feeling uncertain about their next steps—especially when it comes to turning 401(k)s and employer plans into dependable income. Many of the people she works with are worried about market volatility, taxes, and the fear of running out of money. Shawna’s role is to replace that worry with clarity. She creates customized retirement income plans designed to bring confidence, stability, and peace of mind.

She is the author of Retire With Moore: The Holistic Approach for a Relaxed Retirement and has been featured in multiple media appearances, including recent television interviews on Social Security strategies, tax-efficient planning, and navigating retirement in a changing economy. Shawna also holds the Retirement Income Certified Professional (RICP®), Financial Services Certified Professional (FSCP®), and Life Underwriter Training Council Fellow (LUTCF®) designations.

Above all, Shawna takes a relationship-first approach. She believes financial planning is about truly understanding each client’s story and helping them feel supported every step of the way—before, during, and throughout retirement.

David Moore

DIRECTOR OF OPERATIONS & RETIREMENT PLANNER

Dave Moore supports the firm both operationally and in client-facing retirement planning. In addition to overseeing the marketing, branding, and communication strategies for Moore Wealth Management, Dave assists clients directly with their Medicare planning, insurance needs, and overall retirement planning—helping ensure every family has a clear, confident path forward.

Before joining Moore Wealth Management full time, Dave spent over two decades coaching a nationally recognized baseball program and running youth baseball camps. He also consulted for a sports agency and helped organize one of the top baseball tournaments in the country. Through these leadership roles, he mentored hundreds of young men, helping them build the discipline, character, and mindset needed for long-term success.

Dave’s extensive experience working with athletes naturally complements his work in retirement planning. He has a deep understanding of the unique financial challenges current and former athletes face—from income variability to career transitions—and he brings a thoughtful, relational approach to helping them and all Moore Wealth clients achieve long-term financial stability.

Nicole Delozier

Office Manager

With over 25 years of experience in Office administration, Real Estate, and Construction Project Management, Nicole brings a wealth of knowledge and expertise to our team. Nicole and her husband, Derek, relocated from Oregon in 2021 and have three boys. They are a sports-loving family, especially when it comes to baseball! They enjoy watching their boys play sports, traveling, and exploring the beautiful desert landscapes through hiking.

Family Approach

Our approach is truly specific to each individual and their unique needs, goals, and comfort level. We want to build lifelong relationships with our clients so that we can take them from their careers to pre-retirement with a plan into actual retirement and beyond.

We still have clients that Shawna has been working with since 1999, when she first started in the business back in her hometown of Yakima, WA. No matter where our main office is or where our clients might move, we are here for them to make sure that the plan we put together is maintained and continues through our clients’ retirement.

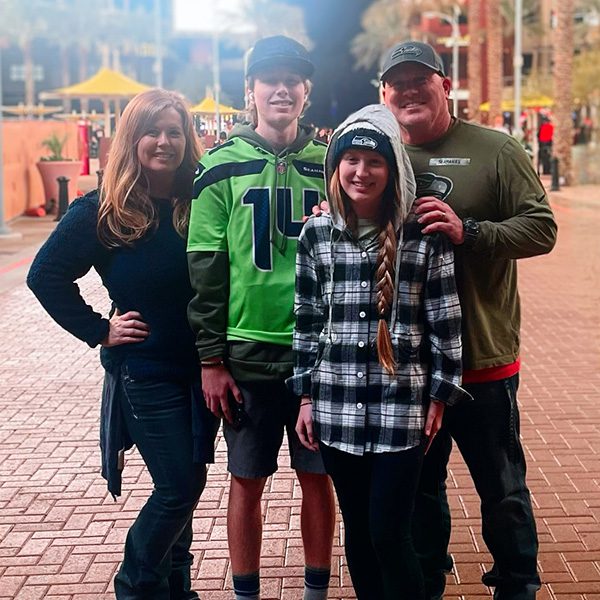

Dave and Shawna have two children and are a committed sports family, spending many of their weekends at their children’s baseball and soccer games. They both love traveling, attending professional sporting events, fitness, hiking, boating, river life, and a good country or rock concert.

Strategic Alliances

MICHAEL BINGER, CFA®

President of Gradient Investments, LLC

As President, Michael is the leader of Gradient Investments and has been with the firm since 2012. He brings more than 35 years of industry experience, including prior roles managing multi-billion-dollar portfolios for an institutional asset manager. Michael is a CFA® charter holder and is a frequent contributor on CNBC, Fox Business, Barron’s, and the Wall Street Journal.

KEITH GANGL, CFA®

Senior Portfolio Manager of Gradient Investments, LLC

Keith joined Gradient Investments in 2018 and has more than 30 years of industry experience. Prior roles include senior portfolio manager for a large institutional asset management firm, managing a multi-billion-dollar portfolio. Keith is a CFA® charter holder, managed a Lipper Award-winning mutual fund, and has been featured in media outlets such as CNBC, Bloomberg, Investor’s Business Daily, Nasdaq and Reuters.

KYLE BERGACKER, CFA®

Portfolio Manager of Gradient Investments, LLC

Kyle joined Gradient Investments in 2025 and has more than 15 years of financial services experience. Prior roles include portfolio manager with a couple of large international institutional asset management firms, also was an advisor with a retail wealth advisory firm. Kyle has developed experience with financial advice, asset allocation, and investment analysis across the asset spectrum. He is a CFA® charter holder and has appeared on the Schwab network.

This endorsement of Gradient Investments, LLC is provided by an investment advisor who refers clients to Gradient Investments, LLC. A conflict of interest exists because this investment advisor receives a portion of the annual management fee charged by Gradient Investments, LLC, based on the assets under management of this investment advisor’s clients. This endorsement could assist in the investment advisor increasing the assets placed with Gradient Investments, LLC, and therefore their compensation. These investment advisors are not affiliated with or supervised by Gradient Investments, LLC.